The Future of Airlaid Nonwovens to 2027

2022-11-16 22:00

The Future of Airlaid Nonwovens to 2027

Airlaid nonwovens are on an attractive growth trajectory, according to the latest exclusive data from Smithers – the leading consultancy for the paper, packaging, and nonwovens industries.

ts report the Future of Airlaid Nonwovens to 2027 shows the market will top $2 billion in sales for the first time in 2022. Further growth is then forecast, with a compound annual growth rate (CAGR) of 7.7%, bringing the overall market value to $2.93 billion by 2027 at constant prices. Consumption of airlaid nonwoven products will increase from 574,800 tons to 768,800 tons during the same period, representing a CAGR of 6% during 2022-2027.

Sustainable Potential

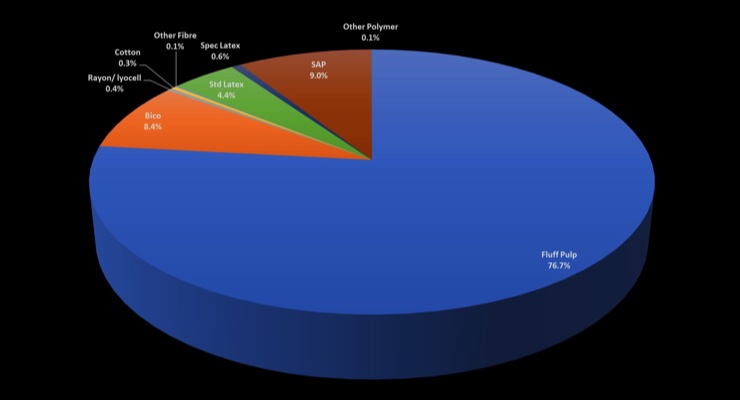

Sustainability is one of the main factors driving the widespread use of airlaid nonwovens. The raw material base is about three-quarters fluff pulp, which is cultivated from softwood trees, is biodegradable and is one of the lowest cost raw materials in nonwovens. Like any industrial process, airlaid production does require energy – primarily natural gas – but it is one of the least energy-intensive nonwovens production technologies, using very little water and few chemicals.

Airlaid market shares by raw materials 2022

As such, airlaid offers a powerful solution for brands looking to reduce their environmental impact – including legislative pressure for more flushable wipe substrates. Innovation is further reducing the use of polymers. Notably Glatfelter has developed non-plastic adhesives that are now being used in some of its airlaid products.

Sustainability is particularly attractive in some key end-use segments, notably feminine hygiene products (35.8% of the market in 2022, by weight), wipes (23.6%), tabletop media (13.6%) and food pads (9.2%). These are all consumer applications and single use. In durable and industrial nonwovens, airlaid has a much smaller share in limited-use sub-segments such as cabin air filters in filtration, flame retardant mattress barrier fabrics, apparel and liquid filtration.

Heavier Substrates

Many of the highest volume airlaid sections are highly integrated. A handful of companies dominate the supply of traditional airlaid substrates ranging in weight from 40-300gsm, with an average in the 70-80gsm range. Following the acquisition of Georgia Pacific's airlaid business and Jacob Holm in 2021, Glatfelter now controls around 30% of the global airlaid capacity – more than the next five producers combined. A further limitation is the high barrier to entry for airlaid technology – Fiberweb Italy, Danish Airlaid Technology and Lacell have all failed to gain a foothold in this market over the past decade.

There is new potential for heavier airlaid substrates in the 500-1500gsm range. The major end uses of these materials are in packaging, insulation and molded consumer products. The heavier substrate segment is an easier market for new companies to enter because they do not have the same requirements for basis weight and density control. Furthermore, they are now economically viable due to recent process improvements – using very open spike former to optimize yield at the expense of fine formation control.

What a small segment of the market today (6.8% by weight in 2022); these demands are accelerating. In packaging, airlaid is favored for its protective and insulating properties, for example in temperature-controlled delivery formats, where it is a more sustainable alternative to existing plastic materials. These same qualities are helping these new airlaid substrates replace expanded polystyrene or other foams in the home insulation market.

Molded consumer productss is another new market driven by the desire to replace single-use plastics in forms, such as food trays, cutlery and cup lids.

Capacity

Another major challenge facing the airlaid sector in the next five years is to add suitable capacity to handle urgent demand. Airlaid is the smallest of the major nonwovens markets in 2022 and has the most stringent demand-to-capacity ratio estimated at 92%. 34 major airlaid producers and 24 small airlaid producers with 90 commercial production lines and a nominal capacity of 624,800 tons of product define the airlaid industry in 2022.

For traditional substrates, new capacity is being added as EAM/Domtar launches a new multibond airlaid line in 2022, but no other major expansions have been announced. New capacity must also be balanced against closing older, less efficient airlaid lines.

This is due to a conservative mindset, as well as a collective memory of the impact of massive capacity growth (+37% in a year) during the early 2000s, the ensuing price crash and a round of bankruptcies. Over the next five years, this means that investment in new airlaid lines will continue to lag behind the rate of expansion. Smithers predicts that the demand-to-capacity ratio will increase further to 94% by 2027. In contrast, for the newer heavy substrate market, the rate of expansion is faster, with dedicated commercial lines for each emerging end-use application.

Smithers analysis tracks demand for four main airlaid processes - Multibonded Airlaid (MBAL); Latex Bonded Airlaid (LBAL), Thermally Bonded Airlaid (TBAL) and Hydrogen Bonded Airlaid net (HBAL).

MBAL is the most flexible airlaid process. Can be used to produce LBAL or TBAL; in some cases, HBAL structures as well. Capable of addressing all traditional airlaid markets and testing some newer markets and end uses; TBAL will account for a little more than half of global consumption by weight by 2022. However, MBAL is also the most technically complex process and has the highest capital cost.

The fastest growth will come from TBAL, where demand is expected to more than double in 2027 compared to 2021. TBAL lines are cheaper to operate and offer superior emboss quality on the finished product; and is the technology best suited to benefit from the demand for new heavier substrates for applications such as green insulation and molded consumer products.

Detailed expert forecasting for this sector is now available in The Future of Airlaid Nonwovens to 2027, [https://www.smithers.com/en-gb/services/market-reports/nonwovens/the-future-of-airlaid-nonwovens-to-2027] from Smithers. This is founded on an exclusive market dataset segmented by airlaid process, raw material input, end-use application, and geographic region. The current and future market outlook is further contextualized by a detailed examination of emergent market, regulatory, and technology developments; and profiles of the leading eleven global manufacturers. This expert industry study is available to purchase now for $6,750 (€5,970, £5,250). n

Get the latest price? We'll respond as soon as possible(within 12 hours)